Dear Chair,

I write in response to the Treasury Committee’s call for evidence for its inquiry on Regional imbalances in the UK Economy.

As the Committee may be aware, the Office for National Statistics (ONS) is the UK’s National Statistical Institute, and largest producer of official statistics. We aim to provide a firm evidence base for sound decisions and develop the role of official statistics in democratic debate.

We have focused our evidence on what our economic data show in terms of regional imbalances, including growth, employment, income and productivity. We have also noted our current and planned regional economic data developments to fill data gaps for users.

I hope this evidence is helpful to the Committee. Please do not hesitate to contact me if I can be of any further assistance.

Yours sincerely,

Darren Morgan

Director, Economic Statistics Development, Office for National Statistics

Office for National Statistics written evidence: Regional imbalances in the UK economy – Treasury Committee

Introduction

1. The Office for National Statistics (ONS) is the principal producer of regional economic statistics in the UK and it is our responsibility, in partnership with the Scottish Government, Welsh Government, Northern Ireland Executive and other interested parts, to provide the data that regional policy makers need to carry out their function. ONS engages with devolved and regional policy makers at all levels of administrative geography to identify those needs and their relative priorities, and to respond with appropriate development programs.

2. Over the past decade we have made significant improvements to the range and depth of regional economic statistics we have made available but recognise that there is still more to be done. We are also aware that greater devolution to local administrative bodies is increasing the need for regional data on an ever-growing range of topics.

3. The 2016 review of economic statistics by Sir Charles Bean highlighted the need for better provision of regional statistics and made three main recommendations: for more timely regional economic data; for greater flexibility in the range of geographic areas covered; and for greater use of administrative data in the production of regional economic statistics. These priorities have guided our development program.

4. In our evidence for the Committee we have focused on describing the range of regional economic data that are currently available, what those data show us about regional imbalances in the UK economy, and what we know about gaps in the provision of regional data and our plans to address them.

Summary

5. Looking at measures of economic activity, gross value added (GVA) per head was highest in London, the South East and Scotland, with Wales and the North East lowest. In some places, such as London, and at lower levels of geography, this measure can be distorted by commuting, meaning it should be treated with some caution. GVA growth is also affected by the choice of time period, but in the UK from 1998 to 2017, the Greater London Authority tops the list, with strong growth also seen in Cambridgeshire and Peterborough CA and Aberdeen City Region. Lowest growth was in Scottish Island Council, followed by the Ayrshires and Mid-Wales Growth Deal area.

6. In the labour market, the South West, South East and East of England have consistently shown relatively strong labour market outcomes, while the North East tends towards having the lowest employment rates, highest unemployment and highest economic inactivity. The lowest employment rates tend to be amongst those living within cities, meanwhile the highest employment rates tend to be for those living in more rural areas.

7. Most of the other countries and regions of the UK have very similar productivity levels to each other, excluding London and the South East which have distinctly higher productivity relative to the rest of the country. Looking internationally, London compares with Paris as having one of the highest levels of labour productivity amongst European regions. The South East region of England similarly compares favourably with regions across Europe. However, in the North and Midlands of England, and Wales and Northern Ireland, labour productivity levels are relatively low, comparable with productivity levels in eastern Germany and southern Italy.

8. In trade, London constituted almost half of all exports of services from the UK, and exports of financial services alone from London constituted 13% of all exports of services from the UK. The South East was second in service exports. London and the South East exported the most in Information and Communication services, real estate, professional, scientific and technical services. The North West contributed the most to manufacturing exports.

9. Considering public sector finances, in the financial year 2017 – 18, London, the South East and the East of England all had net fiscal surpluses, with all other countries and regions having net fiscal deficits; Northern Ireland having the largest net fiscal deficit. Across all countries and regions, most revenue is raised from Income Tax, VAT, National Insurance contributions, Onshore Corporation Tax, and excise duties, but in London more revenue has been raised through Stamp Duty Land Tax than excise duties. While London has the highest total public sector expenditure, on a per head basis Northern Ireland was the highest and East of England the lowest.

10. Looking at Gross Disposable Household Income (GDHI) per head, a measure of living standards before housing costs, London had the highest, followed by the South East and East of England. The lower end of the scale is occupied by: Yorkshire and The Humber; Northern Ireland; the North East; and Wales. Considering growth in GDHI per head between 1997 and 2017, London and Scotland grew above the UK average, while Wales and Yorkshire and the Humber dipped below.

11. Looking at household expenditure, the South and East of England generally spent more than those in other countries and regions. If we combine household expenditure with disposable income, we can calculate the households’ saving ratio (the proportion of total resources left over for saving), in which London was highest, followed by the West Midlands and the East of England.

12. Other outputs that ONS and our partners are producing include consumer prices and recently published work on towns. This shows very different outcomes across different towns with some growing very strongly in terms of employment and population growth and some declining on these same metrics.

13. We are aware of gaps in our regional data and are working with our partners and users to fill these, including through flexible geography, regional supply and use tables, better gross fixed capital formation statistics and increased stakeholder engagement through the Centre for Subnational Analysis.

Measures of economic activity

Annual regional gross value added

14. The standard measure of economic activity is gross domestic product (GDP). For regional purposes we normally measure gross value added (GVA), which differs from GDP only in excluding taxes (less subsidies) on products, such as Value Added Tax (VAT). The reason for this is that taxes on products are difficult to measure on a regional basis because they are often paid by consumers, rather than producers. In the short term, movements in GVA are generally considered a good proxy for movements in GDP.

15. The principal measure of GVA at a regional level is the balanced measure of regional GVA produced by ONS and published each December, denoted as GVA(B). This is an annual National Statistic, formed by combining two independent measures of regional GVA, known as the income and production approaches. It is provided as a time series from 1998 to the year prior to publication.

16. GVA(B) is provided in current prices, which include the effect of inflation, and in “real terms” as chained volume measures (CVM) with inflation removed. Each of these is provided as a total for each region, and for a set of detailed industries (defined using the Standard Industrial Classification (SIC) 2007) and intermediate aggregates.

17. GVA(B) is provided for a range of different geographic areas. Some of these are defined by the EU Nomenclature of Units for Territorial Statistics (NUTS) classification, but others have been developed more recently in response to the needs of new bodies with devolved responsibility. To date we have only provided areas that can be constituted from whole local authority districts (or Scottish Council areas). These include combined authorities with elected mayors, other city regions, growth deal areas, local enterprise partnerships, and other economic and enterprise regions of interest to users.

18. We need to safeguard the confidentiality of information relating to any individual person or company and therefore the industry detail we are able to provide diminishes as regional geography becomes smaller. Thus, we provide 81 industries at the NUTS1 level (countries and regions); 72 industries for NUTS2 sub-regions; 48 industries for NUTS3 local areas; and 34 industries for local authorities and any area built from them.

What does GVA(B) show us about regional imbalances?

19. There are two main ways we can look at this: comparing the relative levels of GVA in different parts of the UK; and comparing their GVA growth over time.

20. For comparison of levels we normally look at GVA per head, which takes account of variation in the size and population of regions, allowing places to be compared on an equal basis. However, it is a workplace measure it can be distorted by commuting into or out of an area and therefore GVA per head must be used with caution where there are high levels of commuting.

21. In 2017 London had the highest GVA per head of all NUTS1 countries and regions of the UK, at £48,857. The only other region above the UK average (£27,555 excluding North Sea oil and forces posted overseas) was the South East of England, at £29,415. Scotland was third highest, at £25,485 per person. The lowest countries and regions in 2017 were Wales, at £19,899 per person, and the North East of England, at £20,129. Northern Ireland, Yorkshire and The Humber, and the East Midlands all came in between £21,000 and £22,000 per person.

22. London is far ahead of all other places, but this is certainly partly due to commuting. Across other geographic areas we can see that, in general, cities and commercial centres tend to be high while suburbs and more rural areas tend to be low, reflecting the locations where the activity takes place. GVA per head is not a good way to compare urban and rural areas.

23. When looking at GVA growth we tend to use “real” volume measures, which remove the effect of price inflation, and because we are comparing across time, there is no distortion due to commuting or other factors.

24. At the country and regional level, the choice of time interval affects the story that emerges. If we look at real GVA growth since the low-point of the recession, from 2009 to 2017, the UK as a whole grew by 16.7%. At a regional level London had the highest growth, at 29.6%, followed by the West Midlands at 21.6%. The East Midlands (17.1%), South East (16.7%) and East of England (16.6%) also came in around the same as the UK as a whole. The regions showing the lowest growth between 2009 and 2017 were the North East, at 7.6%, and Yorkshire and The Humber at 8.3%. All other countries and regions grew by at least 12.4%.

25. When we look at combined authorities (CA) and city regions, the Greater London Authority (29.6%) and the West Midlands CA (23.1%) show the highest growth since 2009, followed by the Cambridgeshire and Peterborough CA (22.3%) and North Wales Growth Deal area (20.6%). The West of England CA (17.9%) and Tay Cities Region (16.9) were the only other city regions above the UK average growth. The lowest growth since 2009 among CA and city regions was seen in Liverpool CA (2.4%), Tees Valley CA (2.8%), the Scottish Island Councils (2.9%), and the North East CA (3.5%).

26. However, the economic effect of the economic downturn differed considerably across the UK, so the choice of 2009 can give a slightly misleading picture, as this was not the lowpoint for some places. In Liverpool, for example, 2009 was still strong and the low-point came in 2013 following a decline in manufacturing, construction and public services.

27. If we look at real GVA growth across the entire span of years we have available, from 1998 to 2017, the UK as a whole grew by 43.3%. At a regional level London had by far the highest growth, at 77.3%, followed by four countries and regions all just a little below the UK average: The South East (42.6%); North West (42.6%); East of England (42.4%); and Scotland (42.1%). The other countries and regions showed growth ranging from 38.1% (South West) to 32.2% (Yorkshire and The Humber) with relatively little variation between them over this period.

28. Looking at the combined authorities (CA) and city regions over the same time period, the picture is a little more spread out. The Greater London Authority still tops the list at 77.3% growth, but strong growth is also seen in Cambridgeshire and Peterborough CA (58.8%), Aberdeen City Region (53.9%), Edinburgh and South East Scotland City Region (47.3%) and the West of England CA (46.3%). Greater Manchester CA (41.5%) and North of Tyne CA (41.1%) came in just below the UK average growth. At the other end of the scale the lowest growth since 1998 was seen in the Scottish Island Councils (14.1%), followed by the Ayrshires (20.0%), Mid-Wales Growth Deal area (21.8%) and North East CA (23.5%). It is of note that these are mostly rural and suburban areas.

29. When it comes to the drivers of growth, our figures show that, for the UK as a whole, the strongest growing industries between 1998 and 2017 were: Information and communication (SIC Section J) at 162%; Administrative and support service activities (SIC Section N) at 135%; and Professional, scientific and technical activities (SIC Section M) at 126%. By contrast, Public administration and defence (SIC Section O) fell by 1.5% and Manufacturing (SIC Section C) grew by only 0.2%. The regional distribution of these industries will certainly have played a part in the economic performance of the regions.

Quarterly regional gross domestic product

30. Annual GVA(B) provides a lot of useful information for regional policy makers, but it cannot provide a view of what is going on right now in regional economies. To meet the need for more timely statistics we have been developing a quarterly measure of regional GDP for the nine NUTS1 regions of England and for Wales. We plan to publish this new experimental statistic for the first time in September 2019.

31. Quarterly regional GDP will be published in real terms, with an industry breakdown that matches the corresponding UK GDP publication. It will make extensive use of VAT administrative data alongside various direct volume measures. As the administrative data have a slightly longer lag than monthly survey data, regular publication will be around six months after the end of the quarter when it is first published. We will look to investigate the feasibility of speeding up publication in the future.

32. The devolved administrations of Scotland and Northern Ireland already produce and publish quarterly measures for those countries, and our new development of regional GDP will complete the coverage of the UK at the NUTS1 level. All three of the devolved administrations have been involved in the development of the new statistics, to ensure that they are consistent and coherent with the other measures that are available, both nationally and regionally.

Regional nowcasting

33. ONS has never produced economic forecasts, with our focus being on measuring what has happened. However, we recognise the interest in this area and a recent project

undertaken by a research team in the Economic Statistics Centre of Excellence (ESCoE), established by ONS to harness academic research in the production of economic statistics, has developed a model-based approach to provide early views of regional economic activity, known as “nowcasts”. These estimates are produced soon after the UK quarterly GDP figures are available and are currently published by ESCoE. They cover the NUTS 1countries and regions of the UK.

34. In time we plan to feed data from the new quarterly regional GDP measure into the ESCoE model, to improve the accuracy of its estimates. It is hoped that this work will provide a “flash” similar to the UK’s early estimate of GDP.

Labour market statistics

35. ONS provides a wide range of labour market statistics at both the regional and subregional levels. The Labour Force Survey (LFS) and its derivative the Annual Population Survey (APS) are large household surveys that provide the main sources of statistics on people and their interactions with the labour market. The surveys look at the labour market status of individuals, that is whether employed, unemployed or economically inactive.

36. For those who are employed, information is collected on the nature of the employment; industry, occupation, sector, full-time/part-time, self-employed/employee, nature of contract, hours of work, earnings etc. For those who are unemployed, information collected includes the duration of unemployment. For those who are economically inactive, people are asked about their reasons for not working or looking for work.

37. Employment measures the number of people in paid work and differs from the number of jobs because some people have more than one job. The employment rate is the proportion of people aged from 16 to 64 years who are in paid work. Unemployment measures people without a job who have been actively seeking work within the last four weeks and are available to start work within the next two weeks. The unemployment rate is not the proportion of the total population who are unemployed. It is the proportion of the economically active population (those in work plus those seeking and available to work) who are unemployed.

38. People not in the labour force (also known as economically inactive) are not in employment but do not meet the internationally accepted definition of unemployment because they have not been seeking work within the last four weeks, and/or they are unable to start work in the next two weeks. The economic inactivity rate is the proportion of people aged from 16 to 64 years who are not in the labour force.

39. In addition to information on their labour market situation, a wide range of personal characteristics are collected, including geographic information, sex, age, ethnicity, nationality, country of birth, religion, marital status, health, disabilities and qualifications. This allows these concepts to be cross-tabulated in numerous ways, with the main limitation on outputs the size of the sample available. This means that while it is possible to produce statistics, for small domains the resulting quality is questionable due to high sampling variability.

40. Generally, headline measures of labour market status for regions are taken from the LFS and published monthly on a rolling three-monthly basis, alongside the headline UK labour market measures. More detailed measures, for regions and below region level, are taken from the APS and published quarterly on a rolling twelve-monthly basis.

41. In addition to looking at the supply side of the labour market, business surveys look at the demand for labour. These surveys look at the number of jobs and vacancies that businesses have, along with rates of pay. Like the supply side, for many of these concepts there are short-term estimates that have less granularity available, while annual surveys provide more detail. For jobs the short-term output is Workforce Jobs, which provides estimates of the number of jobs that businesses have filled at a regional level by a broad industry breakdown. The annual equivalent, the Business Register and Employment Survey (BRES), supplies a more detailed breakdown of employment and employees at detailed geographic and industry breakdowns.

42. Again, for earnings the short-term survey provides the Average Weekly Earnings estimates available each month. These are only available at a GB level and are broken down by broad industry and type of earnings.

43. More detailed earnings estimates come from the Annual Survey of Hours and Earnings (ASHE). This larger survey collects information on the various earnings components and hours of work, along with information on the industry and occupations of employee jobs. This provides breakdowns for these various concepts at regional and sub-regional levels. The survey is the basis, not only for detailed information on the rates of pay and hours worked in various jobs, but also for estimating the gender pay gap and numbers paid below pay thresholds such as the National Living Wage.

44. The one notable exception to regional coverage of labour market statistics is vacancies. The ONS Vacancy Survey only provides estimates of the number of vacancies at UK level, split by industry and size of business. Work is ongoing to look at the possibility of producing estimates of vacancies with some geographic aspects, based on techniques such as webscraping, however such information is not currently available.

What do labour market statistics show us about regional imbalances?

45. Estimates have remained consistent regarding the relative regional patterns of the Great Britain regions within the labour market over time. The South West, South East and East of

England have consistently shown relatively strong labour market outcomes: between them they have had the highest employment rates, lowest unemployment rates and lowest economic inactivity rates throughout the period since 1992 when comparable records began.

46. At the other end of the scale the North East tends towards having the lowest employment rates, highest unemployment and highest economic inactivity. The other regions are more tightly packed between these extremes, although Scotland and the East Midlands tend to be nearer the stronger end and Wales the weaker end.

47. These general relationships are maintained whether the UK labour market is strong or weak. However, during periods of a strong labour market the difference between regions narrows, and during periods of downturn, those regions with weaker labour markets suffer more of a shock than the three stronger regions.

48. While the fortunes of the regions of Great Britain show a fairly consistent pattern, Northern Ireland has a higher rate of economic inactivity than the regions of Great Britain and consequently a low employment rate, but this doesn’t necessarily translate into a high unemployment rate, as would be expected for other regions. The ebbs and flows of the Northern Ireland labour market can also be out of sync with the regions of Great Britain, resulting in an unemployment rate that can look relatively high or low depending on the relative economic cycles.

49. When looking at things from a demand side, the picture is slightly different. Although people living in London do not necessarily benefit from high employment rates, those who work in London have the highest median earnings. On the other hand, although those living in the South West have consistently had high employment rates, median earnings are not on a par with those who work in the East of England or South East. However, the low employment rates in the North East and Wales do translate into lower median pay rates. This contrast between urban and rural is often repeated to a greater or lesser extent across the country. The lowest employment rates tend to be amongst those living within cities, meanwhile the highest employment rates tend to be for those living in more rural areas. In contrast, although pay rates in some cities are higher than the surrounding rural areas, this is not always the case.

Productivity

50. In economic terms, productivity is the level of output per unit of input. Labour productivity, therefore, is defined as the quantity of goods and services produced per unit of labour input, for example, per hour worked or per filled job. Productivity matters because increasing productivity is critical to increasing the standard of living in an economy. A more productive economy is able to produce more goods and services, not by increasing inputs such as labour hours, but by making production more efficient.

51. The preferred measure of labour productivity is GVA per hour worked, because GVA and hours are measured on a workplace basis and is the best metric for assessing the economic performance of workplaces in a region or subregion. GVA per job filled can also be used, although it is not quite as good a measure as it doesn’t account for different working patterns across areas. It should be noted that GVA per head is not a measure of productivity and when used as a proxy for regional productivity or economic performance it can be a misleading measure due to the impacts upon it of commuting flows.

52. There are two different approaches ONS have adopted for examining regional labour productivity. The first approach provides a whole economy approach utilising the published regional gross value added (GVA) data. These economic output data are compared with labour input data to produce GVA per hour worked and GVA per filled jobs estimates for a range of different subnational geographies.

53. A second approach is based on examining firm-level productivities using ONS microdata such as the Annual Business Survey (ABS). This approach excludes the public sector and the agriculture and financial sectors of the economy. However, for the rest of the business economy this approach can provide a rich source of information on distributions of firm-level productivity and the opportunity to analyse sources and drivers of productivity.

What do productivity statistics show us about regional imbalances?

54. Labour productivity in Tower Hamlets in London is around 2.5 times higher than productivity in the rural area of Powys in Wales. However, most subregions of the UK have very similar productivity levels to each other, excluding London and the South East which have distinctly higher productivity relative to the rest of the country. Outside of London and the South East (and parts of Scotland such as Edinburgh and Aberdeen), productivity differences within the rest of the country are relatively small.

55. Ranking areas of the UK by productivity level results in 15 of the top 17 NUTS3 areas (out of a total of 170) being located either in London or the South East region, illustrating that this part of the UK is the home to most of the UK’s high-productivity subregions. Productivity levels are particularly high in Inner London which is home to the five NUTS3 areas with the highest productivity. The high-productivity areas in the South East region are mainly located in the west of London along the M4 and M3 corridors.

56. The subregions with the very lowest productivity tend to be predominantly rural areas, such as Powys, Cornwall, and Herefordshire. However, there are also many urban areas that also have low productivity levels, including coastal towns (Blackpool, Torbay) and cities (Nottingham, Stoke-on-Trent, Swansea).

57. Geographical differences in labour productivity in the UK have been persistent over the last 13 years. Data show that the spread in average productivity between NUTS3 areas was increasing slightly before the financial crisis of 2007. However, after 2007, the productivity differences at NUTS3 level decreased slightly, mainly due to lower productivity growth rates in the high-productivity areas of London. Therefore, while productivity differences continue to exist between areas, these differences have not increased over the past decade. Nevertheless, while productivity differences have not been increasing, it is also the case that there has not been much change in the relative rankings of areas through the period.

58. Data on disparities can be compared with other major European countries using data available via Eurostat. These data show that the disparities in the UK between the regions with the highest and lowest productivity are slightly higher than similar comparisons in other major European countries, although other countries (such as France) also exhibit one leading large city with noticeably higher productivity than other regions in that country. The data shows that London compares with Paris as having one of the highest levels of labour productivity amongst European regions. The South East region of England similarly compares favourably with regions across Europe. However, in the North and Midlands of England, and Wales and Northern Ireland, labour productivity levels are relatively low, comparable with productivity levels in eastern Germany and southern Italy.

59. Using micro-data firm-level analysis ONS have explored the reasons behind productivity differences between areas. We have found that differences in firm-level productivity within industries are a bigger determinant of the geographical differences in productivity than the different industry structures of the areas. Differences in productivity within service sectors of the economy between London and other areas of the country are a particularly important source of the differences seen in productivity levels.

60. External factors associated with the location of a firm, such as differing local labour markets, existence of agglomeration benefits, and levels of local consumer spending and factors internal to firms, such as whether a firm-trades internationally, its management practices, and its ownership; age and size of a firm can all have an influence on firm productivity.

61. Overall, the external factors appear to be more important than internal factors in explaining the productivity disparities observed between areas of the UK with London and its surrounding areas benefitting from its deep and high-skilled labour market, good transport connections, high local consumer spending and spill over benefits from agglomeration.

62. In the South of England (excluding London), productivity in larger towns and cities is higher than it is in smaller towns and rural areas. This is a result also seen in many other countries, and usually ascribed to the positive impacts on productivity of urban size via agglomeration. However, in the North and Midlands of England, ONS analysis shows there is no discernible difference between productivity levels in large towns/cities compared with smaller towns and rural areas.

63. The question of the UK’s overall productivity growth performance over time relative to other countries is a very different one. The ONS has recently worked closely with the OECD to better understand the UK’s historic poor productivity performance relative to its international peers in the G7 and identified a need to standardise some data definitions and collection approaches to provide more accurate statistics, although these do not change the headline story that the UK performs relatively weakly. There will be many different factors impacting UK productivity performance relative to other countries, including levels of training and business investment, and we are currently working to better understand the impact of these.

Trade statistics

64. Following engagement with regional Governmental organisations, and discussion with known users of subnational statistics, the ONS Centre for Subnational Analysis identified a need to undertake a project to calculate subnational estimates of international trade in services. This directly contributed toward delivery of the UK trade development plan, meeting needs of other Government departments including Department for International Trade and HM Treasury, and meeting the data needs of regional and local bodies in understanding their local economies.

65. The first publication of estimates of exports of services at NUTS1 geographic level were published in 2016. With funding as part of the ONS Devolution programme, further developments have been undertaken to create geographic breakdowns to the NUTS3 level (and “joint authority” geographies across Britain), and exploratory analysis of destination countries receiving British exports from each NUTS1 area. In Autumn 2019, we anticipate publishing further developments including alignment with national-level statistics, and an improved allocation of exports split by industry.

66. ONS has worked with HMRC in development of these statistics, which in part led to changes in the production of HMRC’s statistics on subnational trade in goods. In July 2019, the ONS Centre for Subnational Analysis started work on creating new estimates of imports of services, to complete the picture of international trade by subnational areas. What do trade statistics show us about regional imbalances?

67. From the latest available estimates of subnational exports of services, for the year 2016, exports of services from London constituted almost half (46%) of all exports of services from the UK, and exports of financial services alone from London constituted 13% of all exports of services from the UK. Second to London’s £117bn service exports was the South East with £39bn.The North East exported the least value of services, £4.2bn or 1.7% of the total, closely followed by Wales with £5.6bn and the East Midlands with £6.0bn.

68. Of manufacturing services, the North West contributed the most to exports, £4.5bn of the £16.8bn total. Manufacturing services contributed almost a quarter of the North West’s total exports of services. After the North West, the South East exported £2.8bn of manufacturing services, and the remaining value spread fairly evenly across the other NUTS1 areas. 69. 78% of UK Information and Communication services were exported from London and the South East, and similarly 70% of real estate, professional, scientific and technical services were exported by these two regions.

70. More than half of service exports from the North West, North East, and Yorkshire and The Humber were in manufacturing, financial and transport services.

71. Outside London, of all NUTS3 areas across Great Britain, Berkshire had the highest exports of services of over £7.7 billion, followed by some of the larger cities including Edinburgh (£5.3 billion), Manchester (£4.6 billion), and Aberdeen City and Aberdeenshire (£4.0 billion).

72. While the average (mean) value of service exports of all 168 NUTS3 areas in Great Britain was approximately £1.5 billion exports of services, if we exclude London then the average across the remaining 147 NUTS3 areas was £0.9 billion.

73. Information on imports and exports of goods at the subnational level can be found in Her Majesty’s Revenue and Customs’ Regional Trade Statistics.

Public sector finances

74. From May 2017, in response to a user consultation, we began producing experimental public sector revenue and expenditure statistics for each NUTS1 country and region of the UK – known as the Country and regional public sector finances. The aim of the statistics is to provide users with information on what public sector expenditure has occurred, for the benefit of residents or enterprises, in each country or region of the UK; and what public sector revenues have been raised in each country or region – including the balance between them.

75. Public sector expenditure is the total capital and current expenditure (mainly wages and salaries, goods and services, expenditure on fixed capital, but also subsidies, social benefits and other transfers) of central and local government bodies, as well as public corporations. Public sector revenue is the total current receipts (mainly taxes, but also social contributions, interest, dividends, gross operating surplus and transfers) received by central and local government as well as public corporations.

76. Net fiscal balance is the gap between total spending (current expenditure plus net capital expenditure) and revenue raised (current receipts), which at the UK level is equivalent to public sector net borrowing.

77. Under the current constitutional arrangements, most aspects of fiscal policy are controlled by the UK government. More recently, however, certain fiscal powers have been delegated to the devolved administrations. The statistics presented in the country and regional public sector finances are neither reflective of the annual devolved budget settlements nor are these data used when calculating devolved budget settlements. Furthermore, they do not provide information on the spending and revenue of individual country or regional bodies such as the Greater London Authority.

What do public sector finances show us about regional imbalances?

78. The most recently available statistics present data for the period from the financial year ending (FYE) 2000, up to and including FYE 2018. Three main aggregates are presented in the statistics – public sector revenue, public sector expenditure and net fiscal balance. These aggregates are presented in absolute terms for each country and region as well as

on a per head basis to account for population differences.

79. Net fiscal balance does not represent borrowing powers of any country or region in the UK. A negative fiscal balance figure represents a surplus (revenue greater than expenditure); and a positive net fiscal balance represents a deficit (revenue less than expenditure).

80. In the FYE 2018, London, the South East and the East of England all had net fiscal surpluses, with all other countries and regions having net fiscal deficits. London had the highest net fiscal surplus per head at £3,905 and Northern Ireland had the highest net fiscal deficit per head at £3,909. The chart below shows public sector revenue, public sector expenditure and net fiscal balance for each country and region from FYE 2016 to FYE 2018.

81. With a largely centralised fiscal system, it is expected that the balance between public sector revenue and public sector expenditure will vary across countries and regions.

82. Across all countries and regions, most revenue is raised from Income Tax, VAT, National Insurance contributions, Onshore Corporation Tax, and excise duties – together, these typically account for 65%-75% of total revenue for all regions. Some variation to this is seen in London, for example, since FYE 2013/14 more revenue has been raised through Stamp Duty Land Tax than excise duties. Additionally, London is the only region where more revenue is raised through Corporation Tax than Council Tax and business rates combined.

83. London had the highest public sector expenditure at £115.8 billion in the FYE 2018; the total for the UK was £794.8 billion. The lowest total public sector expenditure, in the same year, occurred for the benefit of residents and enterprises in Northern Ireland at £26.5 billion. When taking into account the population of each country and region, a different picture can be seen. In the FYE 2018, public sector expenditure on a per-head basis in Northern Ireland was £14,195, the highest of all regions. While the lowest per head expenditure occurred in the East of England at £10,970 per head (UK per head figure was £12,090).

Household income and expenditure

84. ONS provides a regional version of the household sector account, which measures the finances of all people resident in a region, whether they live in conventional households or in communal establishments, such as residential care homes, prisons or student halls of residence. The principal statistic from this account is gross disposable household income (GDHI)11, which is the amount of money people in an area have available for spending or saving.

85. The compilation of GDHI involves measuring all the sources of income that come into households, such as wages and salaries, income from self-employment, rental and investment income, social security benefits and pensions. From these are subtracted money going out, such as taxes on income and wealth, social and pension contributions, and mortgage interest payments. All these components are also published alongside GDHI, giving users a wide range of information about households’ finances.

86. GDHI and its components are provided for the same geographic areas for which we provide GVA(B): NUTS1 countries and regions; NUTS2 sub-regions; NUTS3 local areas; local authority districts (and Scottish Councils); combined authorities; city regions; growth deal areas; local enterprise partnerships; and other economic and enterprise regions of interest to users.

87. Where GVA is a workplace measure, and so GVA per head can be distorted by commuting and demographic variation, GDHI relates to the resident population of an area. This means GDHI per head is a reliable way to compare different areas on a consistent basis to give a measure of relative prosperity. GDHI is only available in current prices, including the effect of inflation, and is only available as an annual time series with a considerable time lag (around 16 to 17 months after the latest year). GDHI also doesn’t take into account variation in the cost of living between different parts of the UK. For that we have developed an experimental measure of regional household final consumption expenditure (HFCE)12, often called household expenditure.

88. Regional HFCE can be measured in two ways, known as the domestic concept and the national concept. The domestic concept provides a measure of how much is spent in a region, regardless of where the people spending have come from. The national concept provides a measure of how much all the people resident in an area have spent, regardless of where they are when they are spending. Both concepts provide spending on a range of goods and services, classified according to the UN Classification of Individual Consumption According to Purpose (COICOP).

89. The national concept can also be provided on a per head basis for direct comparison across different regions. Furthermore, when used in conjunction with regional GDHI, the national concept allows us to complete the story of household finances and derive a measure of gross saving and the households’ saving ratio: the proportion of total resources left over for saving.

90. So far we have provided HFCE for the NUTS1 countries and regions of the UK, in annual time series going back to 2009. In September 2019 we plan to publish both NUTS1 and NUTS2 sub-regions, which will also cover several other contiguous areas such as some of the combined authorities and local enterprise partnerships. In time we plan to develop other areas, at least down to local authority level, but for this we will need to obtain additional administrative or commercial data not currently available to us. What do income and expenditure show us about regional imbalances?

91. In 2017 GDHI per head for the UK as a whole was £19,514. Of the NUTS1 countries and regions, London was by far the highest, at £27,825, followed by the South East (£22,568), East of England (£20,081), South West (£18,984) and Scotland (£18,099).

92. Three regions in the middle of the range have very similar figures: East Midlands (£16,932); West Midlands (£16,885); and the North West (£16,861). Four countries and regions occupy the lower end of the scale: Yorkshire and The Humber (£16,119); Northern Ireland (£15,813); the North East (£15,809); and Wales (£15,754).

93. If we look at growth in GDHI per head between 1997 and 2017, we can see that some regions and countries have grown much faster than others. Over this period most regions grew by between 70% and 76%. However, Scotland grew by 85% and London by 111%. This advanced growth over 20 years has resulted in the present gulf between London and all other parts of the UK. During the same period Wales and Yorkshire and The Humber grew by only 67%.

94. London has the highest levels per person for all of the major income components (wages and salaries, income from self-employment, rental income and investment income) except social benefits (including pensions), for which London has the lowest level per person.

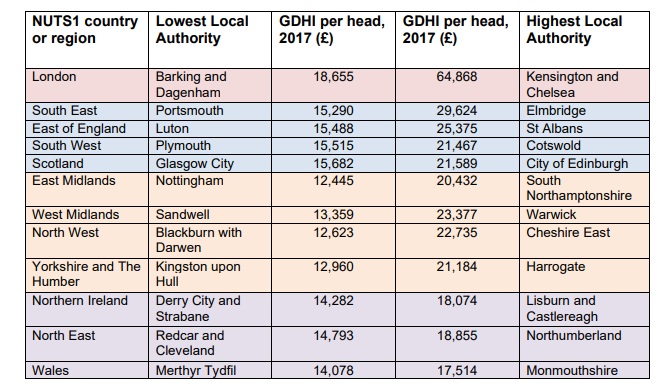

95. The table below shows, for each NUTS1 country and region, the local authorities with the highest and lowest GDHI per head in 2017. This shows the spread of household incomes within each region to see variations.

96. There is a wide range of incomes within each region. London is unique in having far higher disposable income than all other regions; the poorest areas of London are still better off than the richest areas of Northern Ireland and Wales. The upper band (South and East of England and Scotland) have areas with higher income similar to those in the middle band (North and Middle England), but lack the really poor areas seen in the Midlands and North of England. These are mainly urban areas, as are the poorest parts of every region. Generally, it is the suburban and rural areas that have the highest disposable income in most parts of the UK.

97. The lower band (Northern Ireland, Wales and the North East of England) is characterised by a much narrower spread of incomes, though all are towards the lower end of the scale. There are no areas here that could be called wealthy, relative to the rest of the UK, as they are all below the UK average.

98. GDHI per head can show us variation in the amount of money people have in different parts of the UK, but it doesn’t take account of variation in the cost of living across different areas. Household final consumption expenditure (HFCE) can show us how spending differs

in the NUTS1 countries and regions of the UK.

99. In 2016 total household expenditure per person in the UK as a whole was £18,787. Of the NUTS1 countries and regions, London had highest level of spending per person, at £24,545, followed by the South East (£22,208), South West (£19,164), East of England (£18,873) and Scotland (£18,362). The regions with the lowest spending per person were the West Midlands, at £15,276, followed by the North East (£15,727), Yorkshire and The Humber (£15,953), Wales (£15,965) and Northern Ireland (£16,203). The pattern is similar to that seen in GDHI per head, although London’s lead is rather less in spending, and the West Midlands has an unusually low total spend per person.

100. If we look at spending on particular commodities, we can see further variation in spending. In 2016 people in London spent, on average, £10,289 on housing costs, much higher than the next highest region, the South East (£6,032). People in the North East spent only £3,177 on housing, and the figures were similar for Northern Ireland (£3,279) and Wales (£3,300).

101. People in the South and East of England generally spent more than those in other countries and regions, with the South East region coming out top in many commodity groups. However, Northern Ireland exceeded all others in alcohol and tobacco, and clothing and footwear. People in London spent less on transport than those in neighbouring regions, and the least of all areas on recreation and culture, but the most on education and restaurants and hotels. People in the West Midlands spent the least on food and soft drinks, transport and education.

102. If we combine household expenditure with disposable income (using last year’s GDHI figures for consistency) we can calculate the households’ saving ratio, which gives a measure of prosperity that takes account of the variable cost of living. In 2016 the households’ saving ratio for the UK as a whole was 6.9%. Of the NUTS1 countries and regions of the UK, London was highest, at 14.5%, followed by the West Midlands (12.8%) and East of England (10.1%).

103. All other countries and regions were below the UK average: Yorkshire and The Humber (6.5%); North West (5.0%); East Midlands (3.8%); North East, South East and Scotland (all 3.0%); Wales (2.6%); Northern Ireland (2.5%); and finally the South West (1.5%).

104. It should be noted that these household expenditure figures are experimental and should therefore be interpreted with a degree of caution.

Other data sources

Consumer and producer prices

105. ONS publishes regional inflation estimates for the housing market, however, there is currently no regional breakdown for the suite of headline consumer price indices.

106. Both the UK House Price Index (HPI) and the Index of Private Housing Rental Prices (IPHRP) are published at a regional level. In the case of the HPI, consistent sub-regional data (to a local authority level) are published each month supplemented by quarterly estimates at a Lower Super Output Area level. The IPHRP is currently only published at a regional level, although plans are in place to develop this output over the next 12-18 months to produce comparable estimates at a sub-regional level.

107. The development of regional Consumer Price Indices (CPI) has been considered previously. However, the suitability of the existing price sample, which is designed for national estimates, for regional price indices has been questioned due to several concerns such as the difference between national and regional baskets, the likely increase in sample size needed to support regional CPI and the prohibitive cost associated with the development of systems to support regional CPI.

108. In 2017, Southampton University, at the request of ONS, carried out research to assess the suitability of using current price data in the calculation of regional consumer price indices, to quantify the limitations of using this current CPI data and identify the ongoing requirements to allow for the production of regular regional CPI. The research report, along with a rudimentary set of regional indices was published in November 2017.

109. This was followed by with a further period of research in 2018/19, again led by Southampton University, to look at modelling approaches that could potentially stabilise some of the volatility, particularly in the regional weights, seen in the regional indices published in the initial Southampton Report. This work will be followed up in 2019/20 by further research that considers how the CPI price sample can be improved, either through modelling or by utilising alternative data sources, to improve the estimates of regional CPI that can be produced. This research is expected to be published by April 2020.

Towns

110. In July 2019, ONS published the first in a series of outputs which will provide new data and analysis on towns in England and Wales. Alongside existing data for cities (which is generally easier to compile due to the larger size of cities) and rural areas (the Department for the Environment, Food and Rural Affairs (DEFRA) publishes analysis about the rural economy utilising the GSS Rural Urban definition).,The data on towns will allow for more understanding of the similarities and differences between city, town and rural areas as well as providing much needed evidence on which towns are growing and which towns are struggling.

111. Basing the analysis on 1,186 urban areas with population between 5,000 and 225,000, the data showed that the average employment rate of residents in towns in 2017 was slightly higher (75.7%) than the average for England and Wales overall (74.9%). The rate was highest for small towns (77.3%) and lowest for large towns (74.3%).

112. In terms of the recent performance of towns, the analysis found that between 2009 and 2017, 49% of towns had employment growth above the average for England and Wales, and 30% of towns had population growth above the England and Wales average.

113. Overall, our initial analysis does not suggest that towns are more deprived than the rest of the country or performing worse economically. However, the analysis does show very different outcomes across different towns, with some growing very strongly in terms of employment and population growth and some declining on these same metrics. For example, between 2009 and 2017, employment declined in 26% of towns, most commonlyin towns with existing higher levels of income deprivation, but employment increased by over double the England/Wales average in 32% of towns.

114. The analysis provides useful evidence on what types of regional imbalances are most significant in the UK. The towns analysis, alongside existing data on cities, points more towards an imbalance between London and the South East of England compared particularly with the North of England, rather than any difference between types of place such as towns and cities. We will be providing further data and analysis on this topic through the remainder of the year to flesh out these results further.

Data gaps and our plans to address them

Flexible geography

115. One of the priorities identified by the Bean Review is to provide more flexible geographic statistics to meet the needs of new and emerging regional bodies with responsibility for nonstandard geographic areas. In response to this we set up a Flexible Geography project, which aims to develop economic statistics for any user-defined area of interest.

116. To date the project has delivered expansions to the range of areas for which we provide GVA and GDHI statistics, providing estimates for local authority districts and a range of other areas that can be constructed from whole local authorities.

117. In the future we aim to provide these statistics for even smaller areas, drawing upon the wealth of data becoming available to us from administrative sources within government. For GVA, we plan to use VAT administrative data (turnover and expenditure) to break the data down to very small areas; possibly as small as individual workplace zones (c50,000 across the UK), but perhaps lower or middle super output areas (LSOA or MSOA) if workplace zones should prove to be impractical.

118. For GDHI, we will need to secure access to more sources of administrative data, including PAYE and self-assessment data from HMRC, and benefits data from DWP. If successful in obtaining the data we need, our aim here is to break the data down to output areas (c180,000 across the UK), the smallest geographic area for which household statistics can be provided without the disclosure of confidential information.

119. In both cases we aim to produce the smallest possible building blocks, from which we can construct any area of interest to users. Full implementation of this project will take a few years and will involve the development of a dissemination tool capable of handling the

enormous amount of data and constructing the outputs wanted by users.

Regional supply and use tables

120. In our discussions with users, particularly those with devolved responsibility, it has become clear that there is a growing demand for the information provided by regional supply and use tables Regional supply and use enable a rich and detailed picture to be created of all the goods and services produced or imported in an area and their ultimate use, and provide the building blocks for the modelling of the economic effects of various interventions or other changes in supply and demand.

121. We already have many of the pieces needed to populate regional supply and use tables, but there are some important pieces missing. Many of these relate to expenditure measures, which are less well developed on a regional basis. We also currently lack regional prices information. However, probably the most challenging gap is the need to measure trade flows between regions, something that doesn’t exist at a national level but without which regional supply and use is simply impossible.

122. We have set out a programme of work needed to achieve regional supply and use tables, which involves a number of individual streams to develop the parts needed to complete the framework. We do not yet have the resources or funding to carry out this work, but we have

plans ready to begin as soon as appropriate funding can be secured.

123. In preparation we have commissioned a project by ESCoE to carry out research into the practical and theoretical issues around regional supply and use, with the aim of developing guidance we can use to ensure we are able to produce good quality tables at a regional level.

Gross fixed capital formation

124. We already produce regional estimates of gross fixed capital formation (GFCF), otherwise known as capital expenditure. We compile estimates on an annual basis for NUTS1 and NUTS2 level regions and sub-regions, which are delivered to the EU under the European System of Accounts (ESA) 2010 Regulation.

125. However, we are aware the quality of these regional statistics is not very good. The principal data source for regional capital expenditure is the ONS Annual Business Survey (ABS), which provides regional estimates through an apportionment model. While this model works well for most economic variables, it is not a good way to allocate capital expenditure, which tends to contain very large expenses linked to specific sites, such as new building construction

126. We are investigating acquiring access to Corporation Tax records held by HMRC, which contain a lot of information on companies’ expenditure, both operating and capital. We hope that this administrative source will provide better coverage of capital expenditure, enabling an improvement to the quality of our regional GFCF statistics. If successful this will be followed by full domestic publication, and quite possibly the development of additional geographic areas.

Ongoing stakeholder engagement

127. In addition to our well established and comprehensive user engagement, with additional funding secured during the 2015 Spending Review, and in support of recommendations from the Bean Review, we created a new Centre for Subnational Analysis. This includes both existing priorities around subnational economic analysis and spatial analysis, as well as an expansion of our ability to engage directly with stakeholders and to deliver additional analysis at lower geographic levels. Through 2018 and 2019, we conducted workshops with the new Combined Authorities, as well as engagement with other City Region stakeholders, membership organisations, and individual local authorities. These activities aimed to introduce the data ONS has available, to gather feedback and requirements those authorities had of statistical outputs, and to build working relationships with analysts across the country. It has also enabled closer engagement on projects such as the local Industrial Strategies, developments with data science, and work in support of the Stronger Towns Fund.

128. To continue these relationships, the increased information sharing through our user group and our newsletter, and the improved access authorities have to ONS information, we hope to be able to secure funding beyond the end of the Spending Review period. The requests and requirements discovered through our workshops and stakeholder engagement highlighted gaps in subnational information, and potential collaborations that could serve to improve understanding of known policy issues. Dependent upon funding, we aim to transform these requirements into deliverable outputs covering a wide variety of topics in direct response to the needs of local and combined authorities.

Office for National Statistics, August 2019

Related Links:

- Office for Statistics Regulation written evidence to the Treasury Committee as part of their inquiry: Regional imbalances in the UK economy. (June 2019)

- Office for National Statistics and Office for Statistics Regulation oral evidence to the Treasury Committee as part of their inquiry : Regional imbalances in the UK economy. (October 2019)

- Office for National Statistics follow-up written evidence to the Treasury Committee as part of their inquiry : Regional imbalances in the UK economy. (January 2020)

- Office for Statistics Regulation follow-up written evidence to the Treasury Committee as part of their inquiry: Regional imbalances in the UK economy. (January 2020)