Dear Chair,

I write in response to the International Trade Committee’s call for evidence for its inquiry on the coronavirus (COVID-19) pandemic and international trade.

As the Committee will be aware, the Office for National Statistics (ONS) is the UK’s National Statistical Institute, and largest producer of official statistics. We aim to provide a firm evidence base

for sound decisions and develop the role of official statistics in democratic debate.

We have focused our evidence on the new analysis we are doing to illustrate the impact of the pandemic on international trade, and how we are ensuring continuity of the data more broadly.

Continuity of the data

The ONS have prioritised assessment of data supplies to give early signal of potential data gaps and, or reduction in data quality. For Trade in Goods (TiG), the ONS works closely with HMRC colleagues to receive monthly data deliveries, including separate files for EU and non-EU data. The EU data is the imports and exports between the UK and each member state and is collected via a monthly survey called Intrastat. We are reassured that, as an online survey collection platform, HMRC can maintain business survey engagement and high response rates. Non-EU data are taken from the customs declarations which are timelier and have been used in the delivery of real time indictors (non-EU weekly packs) captured in the next section.

For Trade in Services (TiS) the challenges have been more immediate. Data from the International Trade in Services (ITIS) survey is the largest TiS data source, contributing around 50% of inputs into TiS. To date, ITIS data collection has not been moved online meaning the majority of businesses provide data via the paper survey. Our experience more generally is that businesses are finding it harder to respond to paper forms during the coronavirus pandemic, perhaps as staff working from home have limited access to post. Our mitigation strategy to account for anticipated fall in response rates has been to ensure the techniques for dealing with missing data, known as imputation, remain robust; specifically, whether the existing methodologies cope with lower

response and produce meaningful estimates that can be used to produce TiS estimates.

One approach to developing imputation models is to identify relationships between ITIS data and other economic data. Our research shows that there is a strong predictive relationship between the Index of Services (IoS) and Index of Production (IoP) turnover data, which are the two largest data sources that contribute to early estimates of GDP, and ITIS data. As such, models have been developed to estimate ITIS data based on wider movement in the economy. These estimates will be used alongside actual ITIS survey data, external indicators, and feedback from firms themselves to supplement and quality assure the survey data if needed. We will continue to review and refine this model, if required.

Alongside these steps, work is also underway to set up an online mode for the ITIS survey, which will enable companies to be sent spreadsheet-based surveys to complete and email back to us.

Planning is for this system to be set up in time for the quarter 2 2020 data collection cycle which begins in July 2020.

Data from the International Passenger Survey (IPS) makes up over 20% of TiS. With the IPS suspended, finding a new data source or statistical model has been high priority. Our investigations have concluded that alternative data sources for the IPS do not have the granularity and breadth of data that IPS have. For example, no data source looks at total travel expenditure so a number of sources will be required to provide a good working model. There is also a limited number of potential data sources, which poses a challenge to provide the variety of data that IPS is currently used for. This is a priority area for research.

New analysis to shed light on trade during the pandemic

In the short term, the priority for the ONS has been to ensure high quality trade data are available, while addressing the challenges set out above. To ensure transparency, additional briefing has been added to our statistical outputs to notify data source changes and to quantify their impact. Examples of additional communication can be found in the UK Trade February 2020 publication.

Our trade data publication is comprehensive, covering 234 countries and 125 categories of goods and services. This allows users to tailor their analysis to their own needs.

We are also aware that there has been significant demand for more timely information on how businesses are responding to the challenges of the pandemic. To further shed light on trade impacts, a series of trade related questions are included in the faster indicators weekly release.

The business indicators are based on responses from the voluntary, fortnightly Business Impact of Coronavirus (COVID-19) Survey (BICS), which captures business’ views on impact on turnover, workforce prices, trade, and business resilience. The survey questions are available in Business Impact of Coronavirus (COVID-19) Survey questions: 4 May to 17 May 2020.

Business Impact of Coronavirus (COVID-19) Survey (BICS)

The BICS was established early on following the coronavirus restrictions and is sent out to a large sample of UK businesses each fortnight. We call each return period a wave, with wave 6 being the latest, running from 18 to 31 May. We have changed a number of the questions on the survey over that time, to reflect the changing situation and also the policy issues of the day. This online survey provides a timely and useful snapshot of the impact of COVID-19 on business conditions and sentiment; we anticipate continuing with the survey, and refining it, for some time. The survey asked respondent questions on the financial performance of their businesses and on the challenges faced in the weeks prior, among other things. The importing and exporting questions in the BICS are designed to capture economic-based information only from businesses who are trading and whose financial performance is outside of normal expectations.

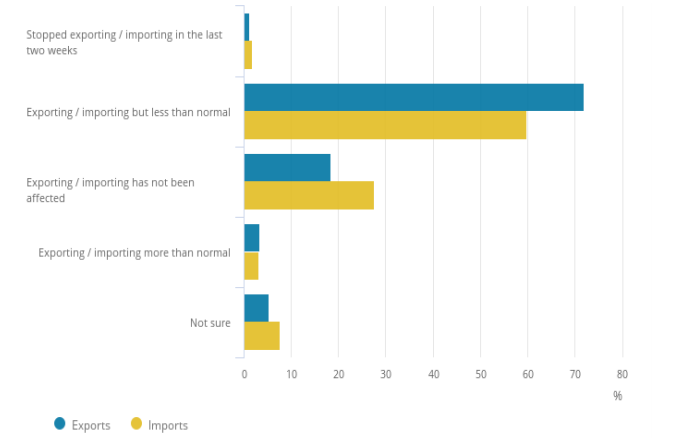

The latest BICs data shows that, of businesses who exported goods or services in the past 12 months and whose financial performance was outside of normal expectations, 78% reported exporting during the coronavirus (COVID-19) pandemic. Of businesses who imported goods or services in the past 12 months and whose financial performance was outside of normal expectations, 79% reported importing during the coronavirus pandemic. Additionally, almost three-quarters (72%) of exporters during the coronavirus pandemic reported that they are exporting less than normal, compared with almost two-thirds (60%) of importers.

Figure 1: Businesses exporting/importing goods or services during the coronavirus outbreak, who were continuing to trade, and those whose financial performance was outside

of normal expectations, UK, 20 April to 3 May 2020

(Final results, Wave 4 of ONS BICS (Exports: n = 898) (Imports: n = 1,174). Bars may not sum to 100% because of rounding)

Source: Office for National Statistics – Coronavirus and the economic impacts on the UK

Alongside the weekly wider BICS publication, the ONS also published a complimentary analysis of the final results from Wave 4 of the BICS for the period 20 April to 3 May 2020, specifically on the impact of coronavirus on exporting and importing in UK businesses.

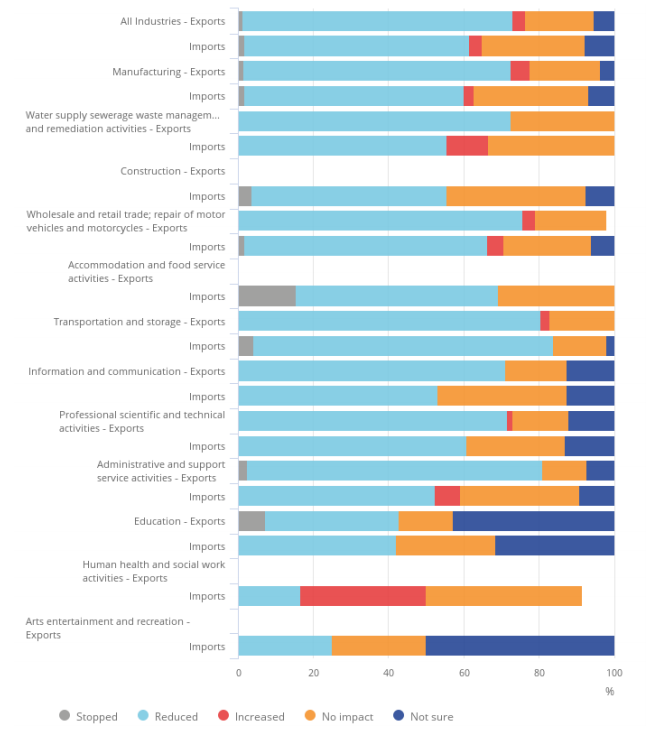

This illustrated that the transportation and storage industries had the highest percentage of businesses reporting that they are exporting and importing less than normal, at 81% and 80% respectively, followed by the wholesale and retail trade industry at 80% and 65% respectively.

Figure 2 show a breakdown by industry, of the effect on exporting and importing on businesses continuing to trade, whose financial performance was outside of normal expectations.

Figure 2. Effect on imported and exporting, businesses continuing to trade, whose financial performance was outside normal expectations, traded during COVID-19, reporting effects of

COVID-19 on trade, broken down by industry.

(Final results, Wave 4 of the ONS Business Impact of Coronavirus (COVID-19) Survey (BICS). UK businesses responding to the Business Impact of Coronavirus (COVID-19) Survey (BICS) who were continuing to trade domestically and internationally and whose financial performance was outside normal expectations (n=898 exp, n=1,174 imp). Results are removed where percentage less than 1% or industry count less than 10.)

Source: Office for National Statistics, Impact of coronavirus on exporting and importing

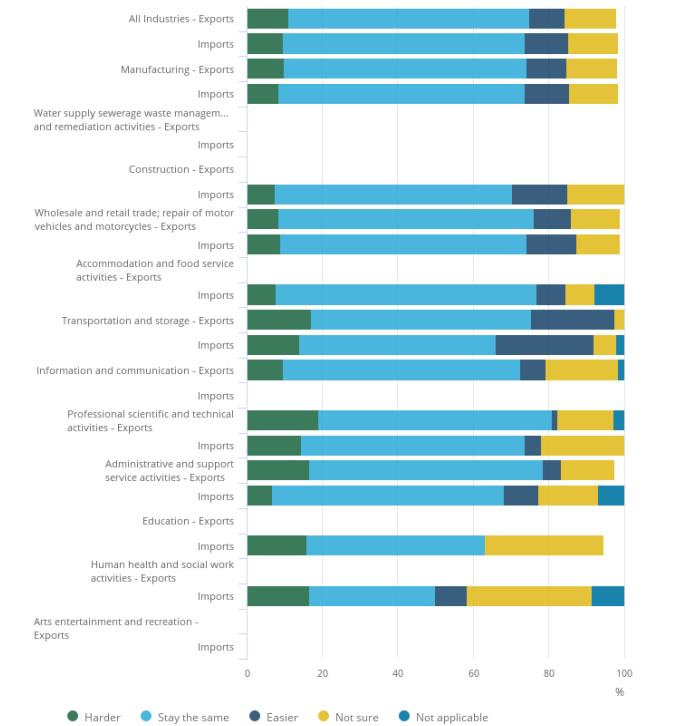

The BICS also surveyed respondents’ expectations for exporting and importing over the next two weeks. Of responding businesses who were continuing to trade and whose financial performance

was outside normal expectations, an identical portion (64%) reported that they expect exporting and importing to be the same over the next two weeks. Figure 3 shows that the majority of businesses expect importing and exporting to remain the same over the next two weeks.

Figure 3. Percentage of businesses continuing to trade, whose financial performance was outside normal expectations, traded during COVID-19, reporting expectations of trading in

the next 2 weeks, broken down by industry, UK, 20 April to 3 May 2020.

Source: Office for National Statistics, Impact of coronavirus on exporting and importing Upcoming data

Our latest wider trade release covers trade for Quarter 1 (January to March) 2020, during which the UK9 and many of its major trading partners introduced measures to combat COVID-19. We will beable to start assessing the full effect on trade in services from quarter 2 of 2020 when data starts becoming available at the end of July 2020.

I hope this evidence is helpful to the Committee. Please do not hesitate to contact me if I can be of any further assistance.

Yours sincerely,

Jonathan Athow