Dear Mr Stride,

I write in response to the Treasury Committee’s call for evidence for its inquiry on the economic impact of coronavirus.

As the Committee will be aware, the Office for National Statistics (ONS) is the UK’s National Statistical Institute, and largest producer of official statistics. We aim to provide a firm evidence base for sound decisions and develop the role of official statistics in democratic debate.

We have focused our evidence on what new analysis we have developed and deployed to highlight the immediate impacts of the pandemic on the economy, and how we are overcoming the challenges of data collection during this time to ensure the UK remains as well-informed as possible, in line with the Committee’s interest.

New data and analysis to illustrate the impact of COVID-19

The ONS has been responding to the need for new data sources in a number of ways. We have deployed three new online surveys, the first being the Business Impact of Coronavirus Survey (BICS), which is being used to collect information on the financial and operational performance of businesses during COVID-19 outbreak. This survey is voluntary and therefore we caveat its results by noting that it may only reflect the characteristics of those businesses who responded. A new individual/household survey has been developed, the Opinions and Lifestyle (OPN) Survey, to help understand the impact of the coronavirus (COVID-19) pandemic on people, households and communities in Great Britain. This illustrates how the impact on the economy is being felt by the population too. Finally, we have also introduced a new Labour Market survey which is an online only survey of households that went live at the end of March, to collect key labour market information plus some specific questions around the impact of COVID-19.

In addition, we can rely on existing administrative data such as VAT turnover data, which so far appear unaffected by the restrictions related to the coronavirus. We also continue to pursue a number of new administrative data sources. One valuable set of data is from the Real-Time Information (RTI) Pay-As-You-Earn, which could provide insights on the labour market. The benefits of this include being more timely than current, survey-based approaches. For example, estimates of employee employment for March were published alongside regular labour market statistics on 21 April.

Moreover, we are considering private sector data sources where they are relevant. We have been able to use our experience on web-scraping – the extraction of data from websites – to produce measures of price change for a basket of high-demand items. In addition, we continue to develop data-sharing arrangements with retailers to get access to scanner or ‘point-of-sale’ data to better measure inflation.

While some of these data sources are more relevant to the understanding the effects coronavirus in the short term, our future data sources strategy will be a mix of traditional survey-based collections and sources such as administrative and private sector.

It will take some time for the overall picture to emerge as more detailed statistics are published. The main insights we can draw at the present are from the Business Impact of Covid-19 Survey (BICS).

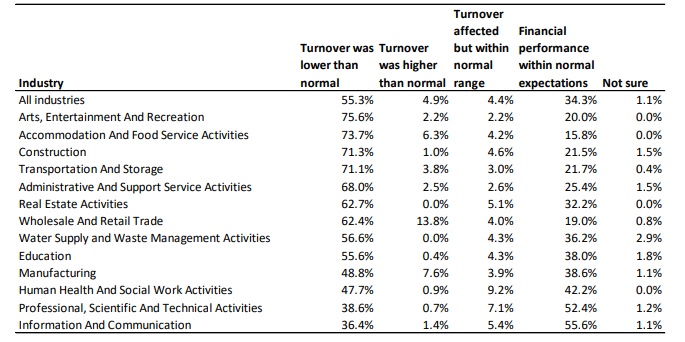

A table from Wave 2 of that survey is set out below, which covers firms who are continuing to trade. It shows that Accommodation and Food Services and Arts, Entertainment and Recreation are the industries reporting the greatest share of firms reporting lower than normal turnover. By contrast, Information and Communication and Professional, Scientific and Technical Activities report the smallest share of firms reporting falls in turnover.

Effect on financial performance, percentage of firms that continue to trade, UK, 23 March to 5 April

Note: Other services and Mining and Quarrying data have been removed from the industry breakdown due to the quality of the response rates, but these industries are included in the industry total.

Economic statistics data collection during a pandemic

The ONS set five priority areas of economic statistics production while the UK is dealing with the COVID-19 pandemic: GDP, inflation, labour market, public sector finances and trade. With the exception of trade, which has some relatively minor issues, the other areas are all experiencing significant effects from COVID-19 and the measures taken to combat it. As we are still working through these issues, and data are still being collected, exactly how it will affect our statistics in terms of quality is unclear.

Regarding the timeliness of our main headline monthly economic statistics, we do not envisage any significant changes, but may need to make minor changes to the publication timetable. In addition, we are streamlining our statistical publications to ensure the headline figures are maintained. Where there are changes to timing, scope or quality of our statistics, we are clear with users. For example, we published plans for changes to our labour market statistics on 3 April.

Restrictions associated with COVID-19 have, understandably, limited our ability to collect data in a number of ways. Many of our economic statistics draw on a wide range of different sources, and have been more affected than others. For example:

• Collection of prices for inflation. Around 45 per cent of the inflation basket (by weight) is collected locally, whereby price collectors visit businesses such as shops to collect prices directly. This is no longer happening, and collectors are intending to collect these data remotely, either by telephone or internet. In addition, some goods and services are no longer being sold, so the ability to collect prices has been constrained. We are developing methods to deal with situations where no prices are being collected, where the number of prices collected is too small to be statistically robust, or the good or service is not currently available. I would note, too, that the UK Statistics Authority and the ONS are fully aware of their duties on RPI as set down in Section 21 of the Statistics and Registration Service Act 2007.

• Interviews for the Labour Force Survey (LFS), which underpins many of the labour market statistics. The LFS uses a combination of face-to-face interviewing in people’s homes and telephone interviews. Following the restrictions on movement, we have stopped face-to-face interviewing and are now relying solely on telephone interviews. This is may result in a reduction in the number of interviews and therefore increase the uncertainty around the estimates. We are continuing to monitor this and develop strategies for increasing response rates.

• GDP statistics rely on a large number of data sources, including business surveys. There are some challenges with business surveys, as response rates may fall for a number of reasons (businesses are not operating, business owners do not have access to the information to respond or individuals are being directly or indirectly impacted by illness etc.) In addition, there are numerous conceptual and methodological challenges given the widely anticipated fall in economic activity, and we are considering how to best compile estimates of GDP in these circumstances.

• Public sector statistics rely on data from central and local government, both of which are under pressures from the coronavirus itself. In addition, there are more than 25 new government schemes that need to be accounted for, significant changes to payment profiles that makes accruals adjustments challenging, and the need to properly capture public sector outputs. We are working closely with local and central government, including the Devolved Administrations, to prioritise and work through issues as they arise.

Looking at regional data, many of our regional statistics are based on surveys of individuals or businesses. Where there are reductions in sample sizes, this will reduce the quality of UK-wide statistics. The effect on statistics by country and region of the UK could be much more pronounced, as broadly speaking, statistical quality is related to the absolute size of the sample. In some cases, regional data may no longer be of sufficient quality.

Alongside surveys, we also use administrative or other sources of data; for example, VAT turnover information is used to measure GDP across the UK. This data collection will be much less affected by lower response rates. On the other hand, changes in administrative systems can affect the data we receive from government.

A further factor is lower levels of capacity in the ONS, and increased demands on our people. As in many other workplaces across the UK, we have some members of staff unwell, and others who have caring responsibilities that mean they are not able to work as normal. At the same time, the demand for data, statistics and analysis – including of some of the new data sources discussed – is putting further demands on us. We are working on how – and whether – we will need to prioritise UK-level data over sub-national breakdowns.

Ultimately the COVID-19 pandemic illustrates, more than ever, the importance of good data and evidence to assist with policy decisions and to serve the public good. The ONS is working extremely hard to ensure we are at the forefront of informing both policy-makers and the public during this time, working at pace to develop new sources of data and disseminate insights from this, while dealing with the challenges in data collection I have set out above.

Please do let me know if I can be of any further assistance to the Committee.

Yours sincerely,

Jonathan Athow

Deputy National Statistician and Director General, Economic Statistics

Office for National Statistics